Usherpa Blog - More Lender Data Demonstrates the Usherpa ROI

We just received the data from a 4-year study performed by one of our enterprise mortgage clients. With 275 loan officers in the company, management allows loan officers to use whatever marketing automation technology they want, or none at all. Does it make a difference?

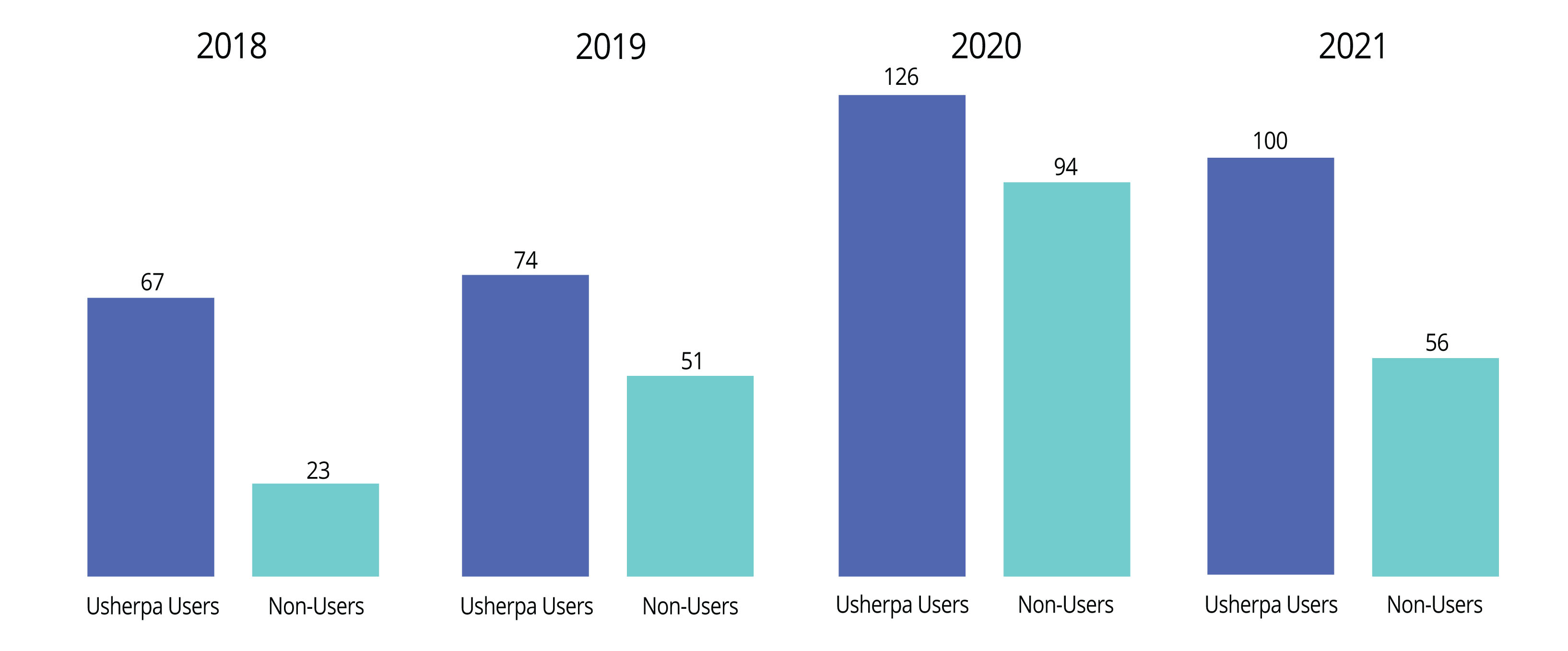

You bet it does. Just take a look at this data.

In 2018, loan officers who used Usherpa’s Smart CRM with its automated marketing capabilities closed nearly 3 times as many loans as those who didn’t.

By 2019, volumes were on the rise across the industry and with falling interest rates lenders were having little trouble capturing new business. Even so, Usherpa users close three loans for every two non-users closed.

But here is where it gets interesting.

In 2020, volume exploded across the industry and the gap narrowed as it became very easy to get new business. Usherpa users closed 34% more loans than non-users. But look what happened in 2021.

Volume was starting to fall. Refinance business was going away and lenders were having to compete for more purchase money mortgage business. Usherpa users were back up to closing twice as many loans as non-users.

What will happen next year? Only time will tell, but we expect to see a repeat of 2018 where Usherpa users are closing 2X - 3X what non-users are closing.

Empower your loan officers with marketing automation and great done-for-you content that you can only get from Usherpa. Reach out to us today.